Scientific progress requires bold action

Because thinking small never changed the world.

Recent Stories

-

AbbVie Foundation Partners Scale Efforts to Advance Racial Equity

See the cumulative progress made by our six nonprofit partners driving health and education equity for Black and other marginalized groups

Read Article -

Magnified featuring Johanna Corbin

Explore Johanna’s incredible career journey from science to law.

Read Article -

Not good enough: behind the drive to give cancer patients more time

Two R&D leaders discuss AbbVie’s approach to develop solid tumor treatments

Read Article -

Recognizing the mental health impact of chronic skin disease

Elevating the standard of care by highlighting the mental, emotional and psychosocial impact of immune-mediated skin conditions.

Read Article -

Magnified featuring Edrice Simmons

Explore the career journey of AbbVie’s VP of commercial oncology.

Read Article -

5 ways AbbVie is working to deliver medicines in half the time

When it comes to creating more time for patients with debilitating diseases, AbbVie’s goals are ambitious—and they need to be.

Read Article -

Working Parents 2023: Finding comfort in community

This year’s working parents share their stories of how they balance work, family and community involvement

Read Article -

Sharpening focus on eye diseases caused by diabetes

The experiences of these AbbVie leaders are aiming to elevate the standard of care for patients with diabetes and vision complications.

Read Article -

Breaking the rules of science to treat cancer

How AbbVie researchers toppled widely held scientific beliefs to create new possibilities for patients.

Read Article -

More than a stiff neck

Explore the impact of living with cervical dystonia.

Read Article -

A legacy of leadership in mental health

Leveraging years of research and development in psychiatry, AbbVie scientists are committed to going beyond ‘good enough’ to make a difference.

Read Article -

Then and now: A renaissance in blood cancer treatment

See how scientists have nearly doubled some survival rates, and why we’re not done yet.

Read Article -

Cultivating change from within

Explore how AMPATH and the AbbVie Foundation are empowering expectant mothers in Kenya

Read Article -

What does it take to discover a new medicine?

In oncology, immunology, virology and beyond, researchers strive to turn science into breakthrough medicines. See how in AbbVie’s Discovery Files series.

Read Article -

Immunology’s Next Frontier

How AbbVie is working to elevate the standards of care for patients with autoimmune diseases

Read Article -

Magnified featuring Nicholas Donoghoe

From studying medicine to leading teams building and launching AbbVie’s pipeline, see the path our R&D chief operating officer took to support patients all over the globe

Read Article -

Green initiatives helping AbbVie grow sustainably

In R&D, operations and beyond, employees do what’s good for patients, people and the planet

Read Article -

Little patients, big impact: Our approach to pediatric oncology

Two pediatric oncologists share their unique background and research approach at AbbVie to help find answers for the youngest patients.

Read Article -

Childhood cancer patients and their families find a home away from home

With AbbVie’s $50 million donation, St. Jude opens a new home-like environment where patient families can relax, recover and connect

Read Article -

Are your needs represented in clinical trials?

Not always, but here's how we can make progress to meet patients where they are.

Read Article -

Voices of AbbVie: Reflecting on a decade of impact

As we recognize 10 years as a company, what makes working at AbbVie unique? Global employees weigh in.

Read Article -

Making it migraine-friendly: Why we’re reimagining the workplace

See how AbbVie is creating a better workplace for people with migraine, the second-most disabling condition in the world.

Read Article -

Discovery Files: A Vision for Blood Cancer Patients

In this episode, veteran chemist Andy Souers rewinds to the “eureka” moment behind a cancer discovery and the 20-year journey to becoming a medicine.

Read Article -

Three factors that drove the transformational integration of AbbVie, Allergan

Here’s how we brought together two diverse businesses and groups of people to build a new, stronger company

Read Article -

Why isn’t medicine one size fits all?

Precision medicine explained: Breaking down how this unique approach and commitment could fundamentally change how we treat disease.

Read Article -

AbbVie rebuilds North Chicago’s middle school

Built with AbbVie's $40 million donation, the new Neal Math and Science Academy now reflects the talent and potential of its students.

Read Article -

3 Lessons for Expanding Equity in Dermatology

Patients of color can face challenges when seeking care for skin conditions. See how we’re partnering with the dermatology community to help drive change.

Read Article -

AbbVie’s family benefits

Explore what makes AbbVie a family-friendly workplace

Read Article -

Inside The DREAM Initiative®

Why we’re reimagining beauty standards in the aesthetics industry

Read Article -

Working Parents 2022: Passion in the Face of Hardship

Despite personal losses and global conflicts, this year’s working parents share why they’re dedicated to helping others.

Read Article -

A history of discovery: Why we focus on challenging eye care diseases

Look at the science behind helping to prevent vision loss and impairment, a leading cause of disability that affects nearly 30% of the world’s population.

Read Article -

Magnified featuring Roopal Thakkar

Our global head of regulatory affairs is on a quest to challenge the status quo and quickly bring therapies and solutions to people who need them.

Read Article -

Meet a director clearing the path for patient access

See how Eyoel Tsegay's work can make a difference for patients

Read Article -

AbbVie volunteers return to serving global communities through Week of Possibilities

With creativity and resilience, 15,000 employees go the distance to serve.

Read Article -

Magnified featuring Sanjay Narayan

Meet our chief ethics and compliance officer

Read Article -

Unlocking the next level of protein degradation

What have we learned about degradomers?

Read Article -

Inside the biology of aging: How do scientists tackle a planet-wide diagnosis?

See how the AbbVie-Calico Life Sciences collaboration turns the traditional partnership upside down to tackle age-related diseases.

Read Article -

Advancing our vision of equity and inclusion

Our 2022 priorities

Read Article -

Magnified featuring Darin Messina

From neuroscience to ophthalmology to bioengineering, see how our head of aesthetic science follows his passions to bring new opportunities to patients.

Read Article -

How can we offer new hope for people with Parkinson’s disease?

The ongoing search for an answer sparked this doctor’s decades-long career in neurodegenerative disease research.

Read Article -

Ready, set, launch: AbbVie opens new facility in the Bay Area

In the birthplace of biotech, we’re continuing our investment in innovation.

Read Article -

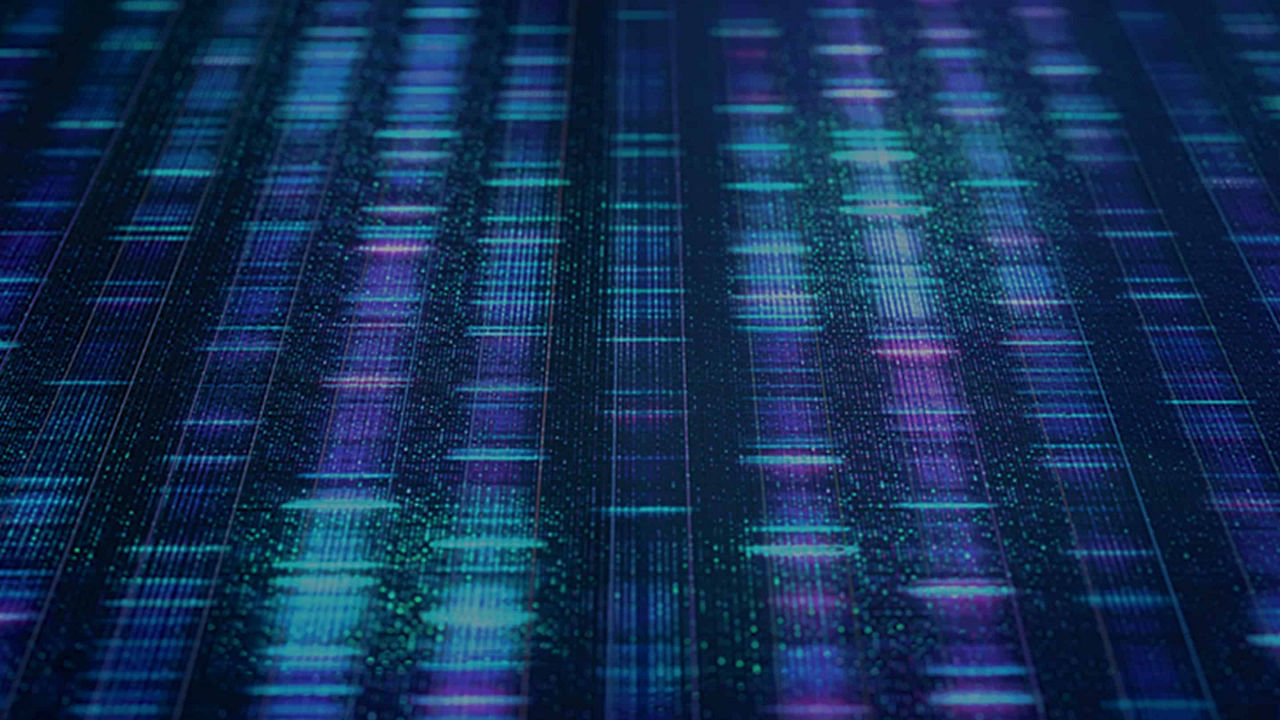

Can unlocking one million genomes help us discover medicines faster?

With the most complete human genome sequenced yet, AbbVie’s Genomics Research Center aims to find out.

Read Article -

Progress toward treating neglected tropical diseases

How public-private partnerships are impacting global public health.

Read Article -

Our approach to data science and analytics

Get an inside look at our largest data initiative

Read Article -

Magnified featuring Jonathon Sedgwick

Meet our head of discovery science

Read Article -

Step by step

Partnership, action and progress in year 1 of our racial equity commitment

Read Article -

Day in the Life: Government affairs director educates and empowers

What are the policies that will sustain scientific innovation? Philip Schwab is looking for answers.

Read Article -

They won’t back down

5 courageous voices on why investment in new medicines matters.

Read Article -

What are science-based targets?

It is the key for sustainable growth.

Read Article -

The unique skills veterans bring to the job

Leaders of our Veterans employee resource group discuss the bonds of military service and all they bring to our workforce.

Read Article -

Magnified featuring Shuhong Zhang

Meet our development sciences VP

Read Article -

How AbbVie helps patients access their prescribed therapies

3 ways we help people get their medicines

Read Article -

Helping women succeed in STEM

5 ways to be an ally for women in science

Read Article -

Magnified featuring Matt Widman

Meet a former chemist turned head of patient services

Read Article -

The story behind our $50 billion R&D investment

Discovering and developing new medicines is not easy. But it’s an aspiration that drives our science and is the foundation of this company.

Read Article -

Beyond accessibility: Meet the next generation of disability advocates

Leaders of our Ability employee resource group share why they champion people with seen and unseen disabilities.

Read Article -

Working Parents 2021: Why their families are centered on service

Our working parents share lessons they’re teaching their kids, from overcoming challenges like military deployment and medical battles to why raising a family should be fun.

Read Article -

Five reasons why small cell lung cancer is tough to treat

Researchers continue to bring into focus the reasons why small cell lung cancer is tough to treat and what can be done about it.

Read Article -

AHORA es el momento

Los profesionales latinx alzan la voz

Read Article -

The time is AHORA

Latinx professionals speak up

Read Article -

Magnified featuring Jasson Gilmore

Explore the unique career path of Allergan Aesthetics' VP of global digital and consumer marketing

Read Article -

Day in the Life: Meet an engineer fostering diversity and inclusion within manufacturing

Carter has made it her mission to help women and underrepresented talent grow careers in STEM.

Read Article -

Connecting patients with care: 3 lessons learned during COVID-19

From cabs to counseling, see how innovative programs across the globe help address patient needs and ensure continuity of care.

Read Article -

Stronger together: A convergence of minds and data

Data convergence is anything but dull when you pair a veteran data scientist with a leader who connected human genome reading to clinical care.

Read Article -

Day in the Life: Creating impact with nonprofit partners

From managing major construction projects to infusing big flavors, see how associate director Krystal Bruno takes on the day.

Read Article -

Finding hope in a pandemic: A conversation with two hepatitis C experts

Views on how the pandemic has influenced the future of how we find and help people living with the disease.

Read Article -

Magnified featuring Sean McEwen

Get to know our VP of quality assurance

Read Article -

The math of migraine

One billion people impacted. Millions of workdays missed. Countless events skipped. The toll of migraine adds up. But so does progress in care.

Read Article -

Magnified featuring Linda Scarazzini

A closer look at the life experiences & career journeys that have shaped AbbVie’s leaders – like our head of pharmacovigilance & patient safety.

Read Article -

Be the change you want to see

Asian business professionals talk career growth, challenges and the battle against hate.

Read Article -

Precision Medicine – it’s not just for oncology anymore

Could precision medicine help immunology patients the way it has helped cancer patients?

Read Article -

Injecting hope, one vaccine at a time

From volunteering at a mass vaccination site to sponsoring a senior clinic, AbbVie helps the most vulnerable get vaccinated.

Read Article -

Navigating ulcerative colitis as a child

A diagnosis at 13 years old, Marisa Troy’s life and her aspirations were greatly impacted by her IBD.

Read Article -

Resilience, responsibility, rising up

Employees around the globe share the pride, challenges and powerful opportunity of being a Black business professional.

Read Article -

Listen with curiosity. Lead with compassion.

AbbVie’s Chief Equity Officer, Rae Livingston, reflects on leading with an open heart and mind.

Read Article -

The hardest-hit: How nonprofits rise to the challenge of COVID-19

Deep in the pandemic, community-based organizations share how they help vulnerable populations.

Read Article -

Inside the world of human factors engineers

Meet the team whose job is to solve problems before they exist

Read Article -

Life after stroke: Living with and researching spasticity

Prompt action is key to combat post-stroke spasticity. Researchers are trying to raise visibility of the condition to help people recognize it early.

Read Article -

Trapped in your own skin

Read Article -

Lessons from a lifelong journey with psoriasis

One person with psoriasis shares her journey — from childhood to working parent — and how her struggles with the disease have empowered her.

Read Article -

Shining a light on glaucoma and eye health

Helping patients get to a doctor sooner.

Read Article -

Living with the unknowns of Alzheimer’s disease

One patient faces the progression of Alzheimer’s disease through family, positivity and supporting research.

Read Article -

Celebrating AbbVie’s 2020 Working Parents of the Year

Up close and personal with our extraordinary moms and dads of the year.

Read Article -

More than itchy skin: Breaking down the complexities of atopic dermatitis

Science is working to uncover the roots of this serious inflammatory disease.

Read Article -

Be brave. Be bold. Be fearless.

How the women of AbbVie empower one another to speak up, take action and leave their mark.

Read Article -

Shedding light upon a misunderstood skin condition: Hidradenitis Suppurativa

After a long journey to diagnosis, one patient finds strength in advocating for herself and others.

Read Article -

How AbbVie is bringing antiviral expertise to the COVID-19 battle

At the first sign of the pandemic, AbbVie began evaluating ways to help, including accelerating discovery efforts and external collaborations.

Read Article -

How uterine fibroids feel to a patient…who’s also a doctor

An AbbVie researcher shares how her own struggles with uterine fibroids influenced her perspective as a doctor and scientist.

Read Article -

Ambassadors in action

Assembling the pieces of a blockbuster corporate culture.

Read Article -

Love is Love is Love

How AbbVie takes PRIDE in embracing its LGBTQ+ community.

Read Article -

Starting with a spark: An inside look at environmental sustainability

A global challenge proves that great ideas come from all corners of a company.

Read Article -

How medicinal chemists are creating new weapons against autoimmune diseases

Creative problem solving and data-driven science helps researchers illuminate a smarter path toward compounds that may address unmet patient needs.

Read Article -

The power of love in IBD

An invisible illness, Crohn’s disease impacts the patient and those closest to them. One patient shares how the love of her life helps her thrive every day.

Read Article -

Ensuring patients around the world get medicines during COVID-19

Facing unprecedented challenges, AbbVie’s resilience makes the difference in helping patients get the medicines they need.

Read Article -

Advancing a public health approach to patient safety

From administering vaccines in war zones to leading the FDA’s drug safety group, our patient safety leaders draw on their experiences to bring a focus on public health.

Read Article -

Advice from a scientist turned physician turned robot builder -- be curious

Why science is a team sport and failure isn’t all bad, says AbbVie’s new Chief Scientific Officer.

Read Article -

Navigating the hidden side of cancer

A cancer diagnosis can upend families’ budgets. Nonprofit Family Reach brings financial relief, and now they’re expanding to help even more families.

Read Article -

Why you can’t wait with rheumatoid arthritis

Why is it important for people to see a rheumatologist sooner rather than later?

Read Article -

Going inside prison walls to help eliminate hepatitis C

A former inmate returns to the prisons of Portugal to help those on the inside focus on hepatitis C care.

Read Article -

How patient voices are changing medicine

An AbbVie leader in patient-centered research helps us to hear and consider the patient voice.

Read Article -

Green chemistry

What's the impact from cleaner, faster chemical reactions?

Read Article -

The value of education: From a dim reality to a bright future

Communities In Schools helped a boy living without electricity grow into a man with a master’s degree. Now he’s paying it forward.

Read Article -

Synthetic control arm: the end of placebos?

Although randomization may always be the gold standard, Big Data is breathing new life into clinical trial design.

Read Article -

A molecular behavior chart: speeding up research with predictive analytics

Whether a molecule acts like a “lobster” or “crayfish” may predict its ability to one day become a medicine.

Read Article -

ChemBeads: Improving artificial intelligence through human ingenuity

Discovering a new medicine isn’t easy. When robots couldn’t help, three scientists found a way.

Read Article -

Rebuilding Puerto Rico

Learn how we're partnering to enhance resiliency and access to health care

Read Article -

Striving for patient centricity, down to the packaging

Understand the future of packaging and how it’s evolving to be more about the patient.

Read Article -

Decoding the Immune System’s Secrets

How do new medicines originate? Meet the team behind early development of AbbVie’s immunology treatments.

Read Article -

The blueprint of you: Unlocking the potential of whole genome sequencing

A genetic pioneer reveals what he learned from mapping his own genome.

Read Article -

Chasing the value of a walk down the aisle

Can you quantify the value of moments that matter? How patient experiences change the equation.

Read Article -

BTK protein: the good, the bad and the ugly

Bruton’s tyrosine kinase helps immune function, but its malfunction may lead to cancer and autoimmune diseases. Scientists are researching new approaches in both areas.

Read Article -

Hepatitis C: the mysterious virus that met its match

The virus that brims with unanswered questions never stopped researchers from solving a few of its mysteries over the last 25 years.

Read Article -

Real-world data rounds out value picture of drugs

Medical records and insurance claims data help companies, regulators, payers and physicians better understand how medicines perform in the real world.

Read Article